Every year the National Philanthropic Trust (NPT), a DAF sponsor and resource of useful industry-focused white papers and information publishes its Donor-Advised Fund Report. NPT surveys a cohort of its peers (this year, 1,151 of them) as well as gathering external information about the DAF ecosystem for this annual report.

There are a myriad of useful statistics in this year’s report, but I wanted to pull out a few that caught my attention.

Giving from DAFs continues on its rocket-ship trajectory

NPT shares that grantmaking from donor advised funds has increased every year since its first reporting in 2009 and has more than doubled in the past five years. Grants from DAFs increased 9 percent to $52.16 billion in 2022, a new high.

Money in, money out is the same

- Contributions and grants grew in tandem. Both grants and contributions saw 9 percent growth rates in 2022.

DAF assets continue to grow, even in a slightly-down market

Once assets are donated to a sponsor, they’re generally liquidated right away and put into a pool of managed assets, like a mutual fund, so this means that the assets held by sponsors are subject to the volatility of the stock market. Even so:

- DAF assets reached $228.89 billion in 2022, the second-highest value on record after 2021, even though the stock market caused a 1.1% decline in assets.

2020 and 2021 were record years for outpouring of philanthropy

It’s not a big surprise that, after experiencing consecutive new highs for DAF payout rates in 2020 (23.8%) and 2021 (28.7%) that DAF giving in 2022 was slightly more modest than the previous two years. Even so:

- The average DAF payout rate in 2022 was 22.5%.

Who did NPT include in the report, and how do they differ?

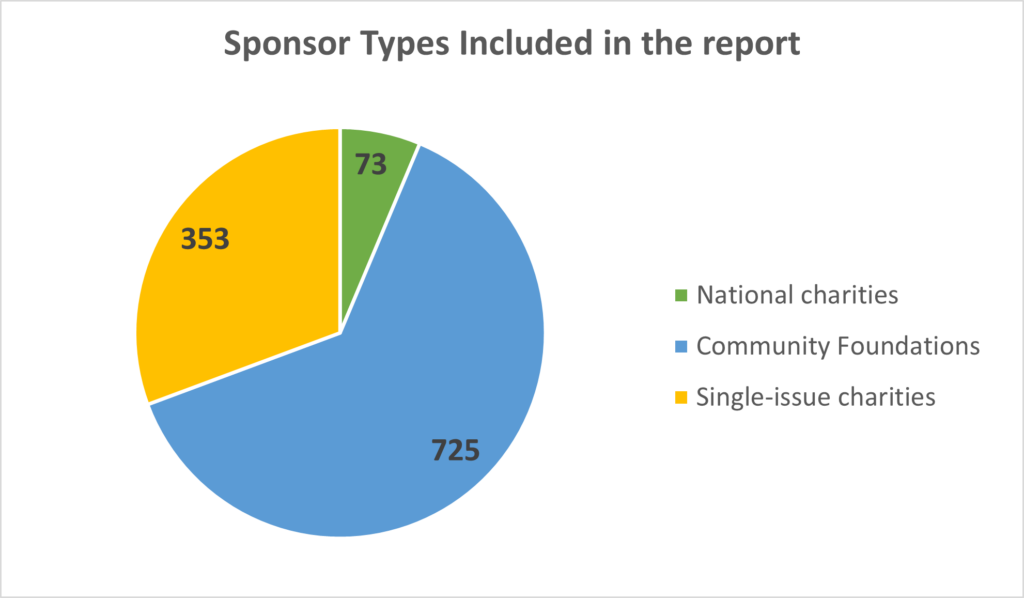

Not all sponsors were included (or opted to participate) in the NPT report, but the DAF sponsors that were covered in the report included:

- 73 national charities (national charities are sponsors such as NPT, Fidelity, and Endaoment, etc.)

- 725 community foundations (CFs include The Boston Foundation, the Silicon Valley Community Foundation, and the New York Community Trust, etc.)

- 353 single-issue charities (Single issue charities include Jewish Federations, universities, and nonprofits like Rotary International).

This cohort of sponsors alone collectively manages 1,948,545 DAFs, so the total number of donor advised funds nationwide is well over 2 million. The growth rate for the number of DAFs over 2021 was nearly 3% (in a year when the US GDP grew 2%).

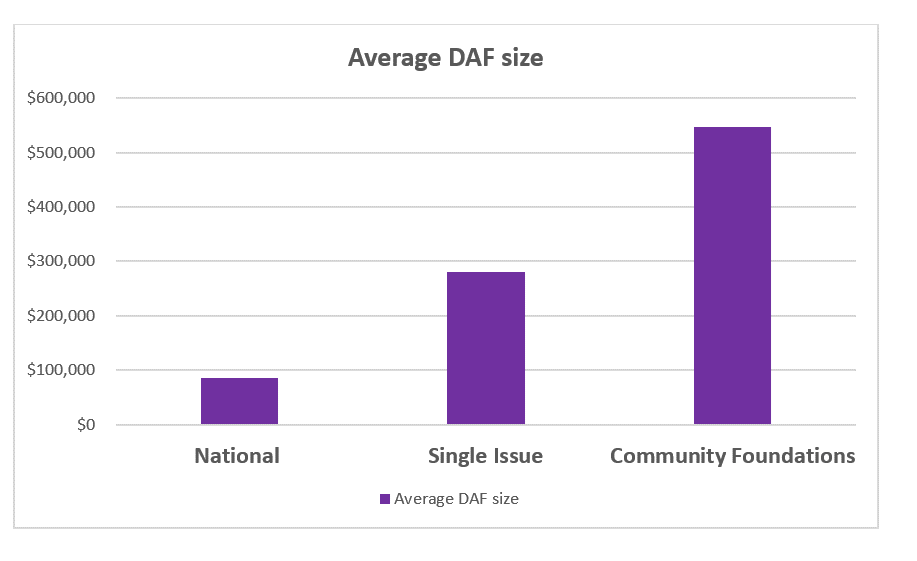

DAF ACCOUNT SIZE

The average DAF account size in this group in 2022 was $117,466 and the average payout rate was 22.5%, but those numbers varied wildly between sponsor type:

National Sponsors (2022):

- Average DAF Account Size: $86,194

- Payout rate: 23.2%

Community Foundations (2022):

- Average DAF Account Size: $547,648

- Payout rate: 19.7%

Single-Issue sponsors (2022):

- Average DAF account size: $281,046

- Payout rate: 26.1%

So in case you’re still wondering if it’s worth engaging with people who have an account earmarked for philanthropic giving, these numbers alone should encourage you to connect with them, or find out if your current donors have DAFs.

DAFs are a huge opportunity for nonprofit organizations.

In a time when philanthropic reporting highlights individual giving decreasing, what we can see is that individuals are in fact still giving – and at a rate of over 20% annually – but instead of writing a check from their personal account, it’s now coming from their DAF.